Trading Strategy with Parabolic SAR

The Parabolic Stop and Reverse (SAR) is a popular technical indicator used in trading strategies to determine potential reversal points in market trends. This article explores an effective trading strategy with Parabolic SAR, making it easier for traders to make informed decisions. For a more detailed guide, visit Trading Strategy with Parabolic SAR Indicator and ADX Filtering https://trading-pocketoption.com/torgovaya-strategiya-parabolic-sar/.

Understanding Parabolic SAR

The Parabolic SAR indicator was developed by J. Welles Wilder, Jr. in 1978 and is particularly useful for determining the direction of an asset’s momentum and potential price reversals. The indicator appears as dots above or below the price on charts. The positioning of these dots indicates whether a trader should consider a long or short position. When the dots are below the price, the market is in an uptrend, and traders should consider buying. Conversely, when the dots appear above the price, the market is in a downtrend, signaling a potential sell or short position.

Setting Up the Parabolic SAR

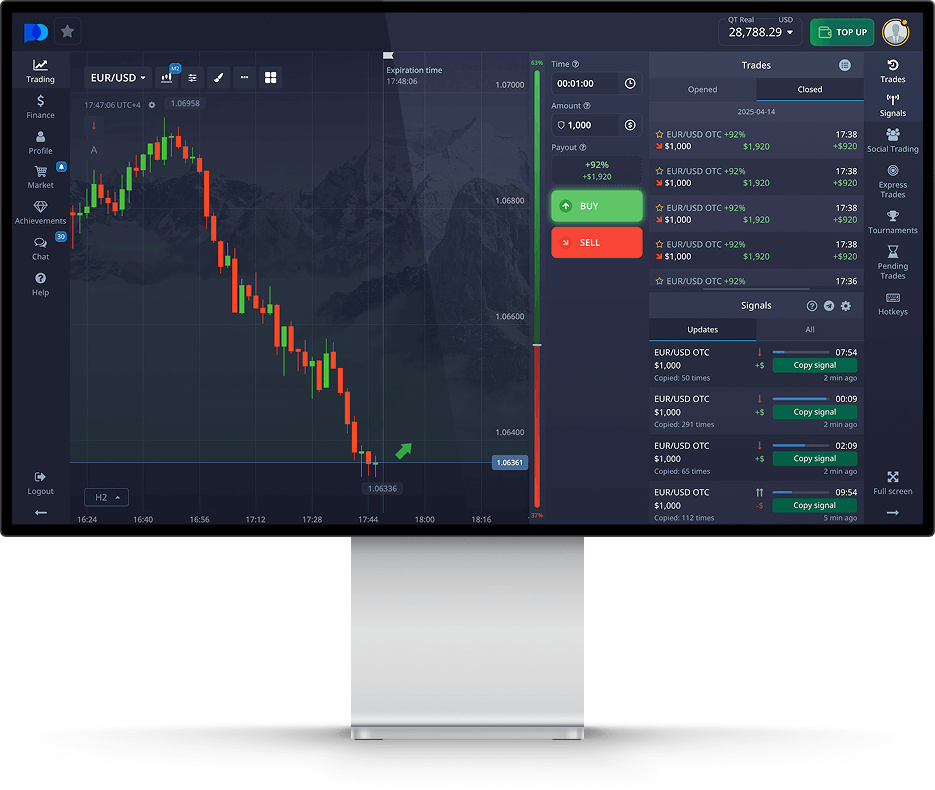

The first step in implementing a trading strategy with Parabolic SAR is to set up the indicator on your trading platform. Most platforms offer the ability to use this indicator easily. You can usually find it in the indicator section, where you can adjust the parameters to suit your trading style.

The default settings for the Parabolic SAR are typically set to an acceleration factor of 0.02 and a maximum acceleration of 0.2. However, traders often adjust these parameters depending on the asset being traded and the timeframe used. A more aggressive trader may choose a higher acceleration factor to capture quicker trends, while a conservative trader might favor the default settings or make minimal adjustments.

Applying the Parabolic SAR in a Trading Strategy

When integrating the Parabolic SAR into your trading strategy, it’s crucial to combine it with other indicators and analysis methods for enhanced decision-making. Here are some approaches:

1. Trend Following Strategy

Utilizing the Parabolic SAR for trend following is a straightforward method. In an uptrend, traders look for the dots to appear below the price, indicating buy signals. Once the dots move above the price, it suggests a potential trend reversal or sell signal.

- Buy when the Parabolic SAR dots are below the price.

- Sell when the dots switch above the price.

2. Integrating with Other Indicators

To improve the effectiveness of trading strategies, many traders complement the Parabolic SAR with other indicators like Moving Averages or the Relative Strength Index (RSI). For example, using a Moving Average alongside can help confirm trends. If both the Parabolic SAR indicates a buy signal and the price is above the moving average, it may validate the uptrend.

3. Support and Resistance Levels

Understanding support and resistance levels is paramount in trading. If the Parabolic SAR shows a buy signal near a strong support level, it may signify a high probability trade opportunity. Similarly, if it signals a sell near resistance, traders may find value in entering a short position.

Risk Management Strategies

Risk management is crucial in any trading strategy. Utilizing Parabolic SAR should include implementing stop-loss orders to protect gains. A stop-loss can be placed slightly below the Parabolic SAR dot when in a long position, and conversely, above the dot when in a short position. This strategy ensures that the trader locks in profits while minimizing potential losses.

Advantages and Disadvantages of Parabolic SAR

Advantages

- Easy to understand and implement.

- Helps identify trends and potential reversals.

- Can be combined with other technical indicators for better accuracy.

Disadvantages

- Can produce false signals during consolidating markets.

- In a strong trend, it may trigger early exit points.

Conclusion

The Parabolic SAR is a valuable tool for traders looking to improve their strategies and better manage their trades. By understanding how to effectively integrate this indicator into your trading routine and combining it with other techniques, you can enhance your trading outcomes. As with any strategy, it’s essential to practice and explore how different parameters and setups affect your results. Being well-prepared will ultimately lead to a more successful trading journey.